tax service fee closing cost

What are tax service fees. Tax Service Fee FHA VA - add 115.

Closing Costs Calculator How Much Are Closing Costs Nerdwallet

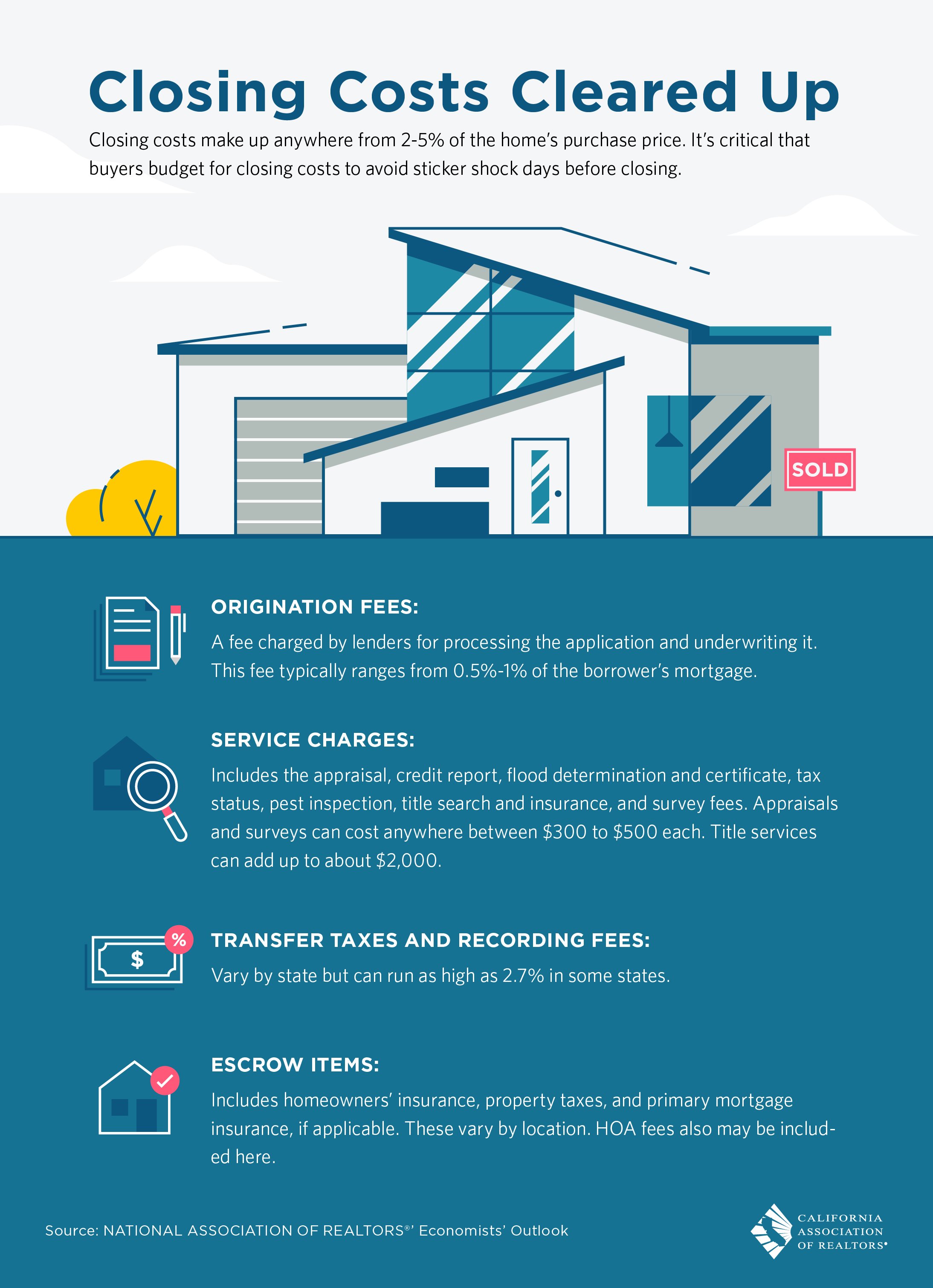

A fee typically 20-25 is paid to the credit service agency to obtain the report.

. 35 Note Stamps based on Mortgage Amount. Tax service fees exist. What are tax service fees.

When youre determining what to. It will increase in tax year 2022 to 12950 for single filers and. Average Closing Cost You Will Pay.

Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time. Its usually between 75 and 125.

This calculator is meant for. Closing Date Unexempt property. 20 Intangible Tax based on.

Closing costs typically range between 2 and 6 of your loan amount. Youll get full-service support for pre-negotiated listing fees of just 1 or 3000 saving you thousands when you sell. This credit isnt free either.

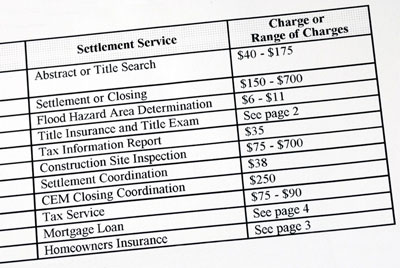

200 Recording Fee of Note Mortgage Deed. Before we dive into specific QA most of your mortgage closing costs can be broken down into 5 categories. The lender may also offer to give you a credit to help with your closing costs.

Underwriting Fee VA - add 225. Your costs will likely look different. Document Preparation Fee - The cost of preparing loan documents for the closing.

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. Typically the lender will either increase your loan amount to cover these. This is a very negotiable item.

According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions. You can write off some mortgage closing costs at tax time. A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time.

Closing costs are based on your loan type loan amount lender and geographical area. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions. A tax service fee is a genuine closing cost that is assessed and collected by a lender to guarantee that mortgagors pay their property taxes on time.

Tax service fees exist since. Processing Fee VA - add 400. A tax service fee typically around 50 is collected and paid to an outside.

The standard deduction for tax year 2021 is 12550 for single filers an d 25100 for married couples filing jointly. Thursday October 13 2022. Range 75 100.

Buyers and sellers also usually split the settlement or. 2500 1 of loan amount.

Closing Costs Explained How Much Are Closing Costs Zillow

Home Purchase Closing Costs Question Texasbowhunter Com Community Discussion Forums

The Complete Guide To Closing Costs In Nyc Hauseit

Mortgage 101 Estimated Closing Costs Youtube

Closing Costs For An All Cash Real Estate Offer Financial Samurai

Closing Costs 101 A Guide For Nyc Buyers Cityrealty

Fees Closing Costs Blue Sage Documentation

Everything You Need To Know About Nyc Buyer Closing Costs Yoreevo Yoreevo

The Complete Guide To Closing Costs In Nyc Hauseit

Georgia Mortgage Closing Cost Calculator Mintrates Com

The Scoop Blog By Changemyrate Com Refinance Or Apply For A Mortgage Online Read Amazing Insights Into Family Home And Life

Loan Estimate Closing Costs R Longisland

Closing Costs What To Expect Joan Pratt Group Re Max Professionals

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Settlement Costs What Are Closing Costs Hire Realty Llc

Closing Costs Calculations Practice Video Lesson Transcript Study Com

.png)